Frequently asked questions

-

The minimum premium per month is €10.

-

The minimum amount of cover you can obtain is €5000.

-

Cancer Cover is available to those aged 18 to 65 and is available on a single, dual or joint life basis.

-

Zurich Life are the only company to offer this cover in Ireland. They are one of Ireland's most successful life insurance companies and have been meeting their customers' needs in Ireland for over 40 years. They are the Irish arm of Zurich Insurance Group which is a leading global multi-line insurer with over 55,000 employees. Zurich are AA rated from Standard & Poor’s.

-

Cancer cover can be taken out on a standalone basis and can be added to other cover in the same way as serious illness cover can be. It is a very good way of adding another crucial layer of protection at a relatively small cost. For as little as €10 per month one might be able to put in place a significant amount of cover.

Note that it can be added to life insurance cover but it cannot be taken out with a mortgage protection policy.

-

It is very important to have financial support at a time of physical and emotional stress. This type of cover can enable you to take the time off work, pay for specialist treatment or even cover day-to-day household bills such as childcare.

The Irish Cancer Society did research in 2015 that showed that cancer can cost a patient up to €2,600 per month……

- Average cost to patient and family of going through the cancer journey is €862 per month (rising to €1,200 in some cases).

- Average loss in income of €1,400 per month.

- A third of working patients give up work

- A quarter reduce their hours

- 64% changed their working practices in some way

That was over 6 years ago so you can imagine as with most things in Ireland – that cost has risen significantly.

Cancer Cover pays out a tax-free, cash lump sum if you are diagnosed with cancer of a specified severity. Click here to see exactly what Zurich cover but all the major cancer

- Breast Cancer

- Lung Cancer

- Bowel Cancer

- Gynae Cancer

- Stomach Cancer

With Cancer Cover, Zurich also provide partial payments for less severe, more treatable types of cancer. These ordinarily include:

- Testicular Cancer

- Early-Stage Bladder Cancer

- Low Level Prostate Cancer

- Cancers in situ

-

If you already have a serious illness policy then there is no need to also get Cancer Cover as under your serious illness policy – you are also comprehensively covered for cancer.

-

It is worth highlighting that Cancer Cover can be taken out by some people who would ordinarily be declined full Serious Illness Cover. This includes people with a medical history of:

- Heart Attacks

- Angioplasty

- Angina

- Valvular Disease

- Stroke

- Obesity

- Diabetes

- Kidney Problems

It also costs much less which is very beneficial where one’s budget cannot stretch far enough to purchase full serious illness cover.

-

It is much cheaper than serious illness cover despite 66% of all male serious illness claims being related to cancer and a staggering 81% on the female side (Source: Zurich Life). Below is a recent comparison showing the difference in cost between serious illness cover and cancer cover.

Male & Female(age next birthday) Cancer Cover - €100,000 Serious Illness Cover - €100,000 25 €10.97 €19.95 35 €20.70 €39.39 45 €39.37 €81.52 *Source: Zurich Life 2021

-

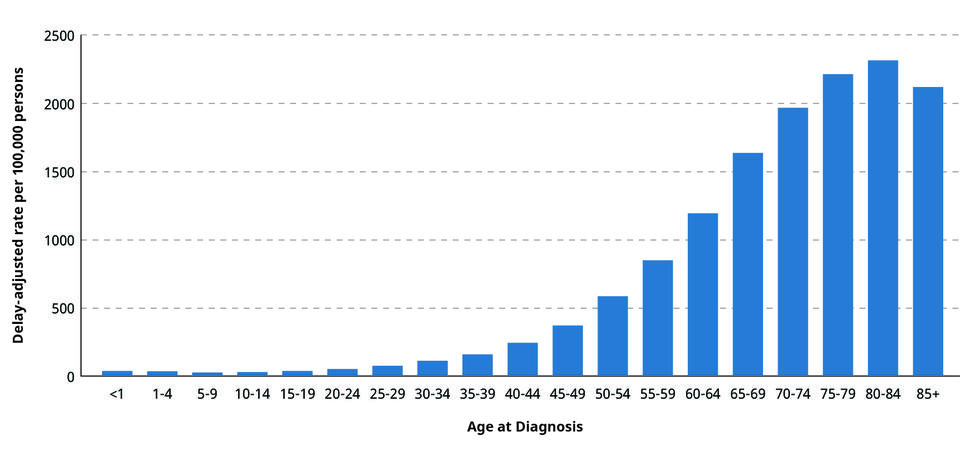

This is the $100 question but it isn’t a surprise that as we get older the odds of us getting cancer also rise considerably so it’s a policy you really need to get before ‘sniper alley ‘ kicks in which is typically between the ages of 55 – 75.

Credit: National Cancer Institute

-

Unfortunately, if you have a history of cancer in any form – you are not eligible for this type of policy.

-

Serious Illness cover pays out a lump sum to you if you are diagnosed with any of the specified illnesses named in the plan e.g. stroke, heart attack, motor neurone disease, cancer etc. Cancer Cover however is as its name implies – cover that is solely limited to cancer related illnesses. If you can afford serious illness cover it provides more cover but for those whose budget may be too stretched to afford this more comprehensive cover, cancer cover is a very good and less expensive alternative.

-

GetCancerCover.ie is a website owned and operated by True Financial Ltd t/a True Wealth Low.ie are one of Ireland’s leading online providers of life insurance and mortgage protection. Since their launch in 2014, Low have successfully obtained over €3 billion in cover for over 12,000 happy customers. Low.ie have a 5 stars rating on global review platform, Trustpilot and are rated 5 stars. Our team of experienced and friendly financial advisers will not only make sure to get your Cancer Cover in place as quickly as it suits and at the lowest price but we will also organise it in whatever way suits you… online, over the phone or by mail.